why is tesla stock so high compared to other companies

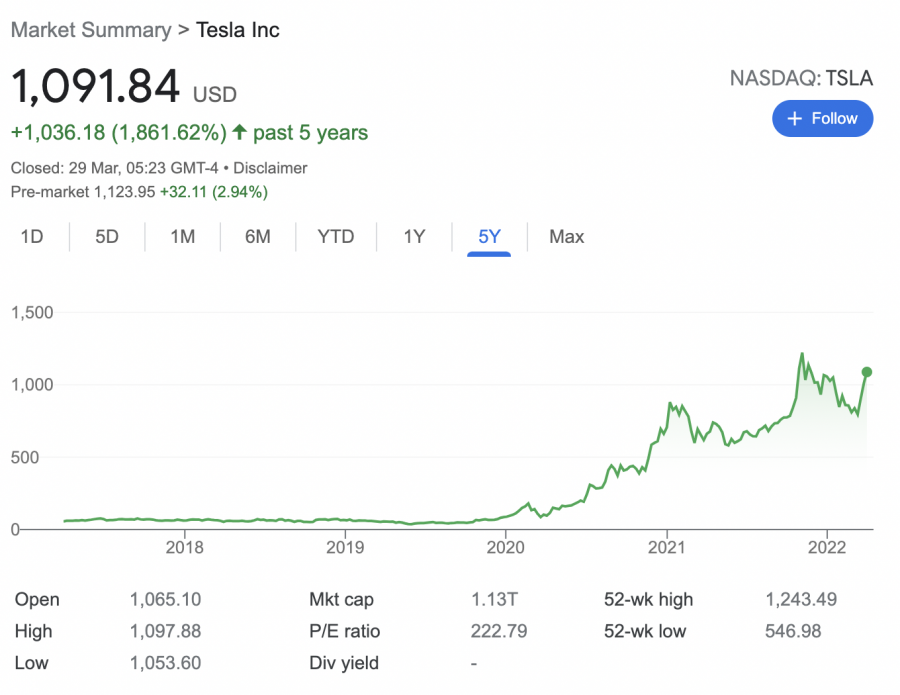

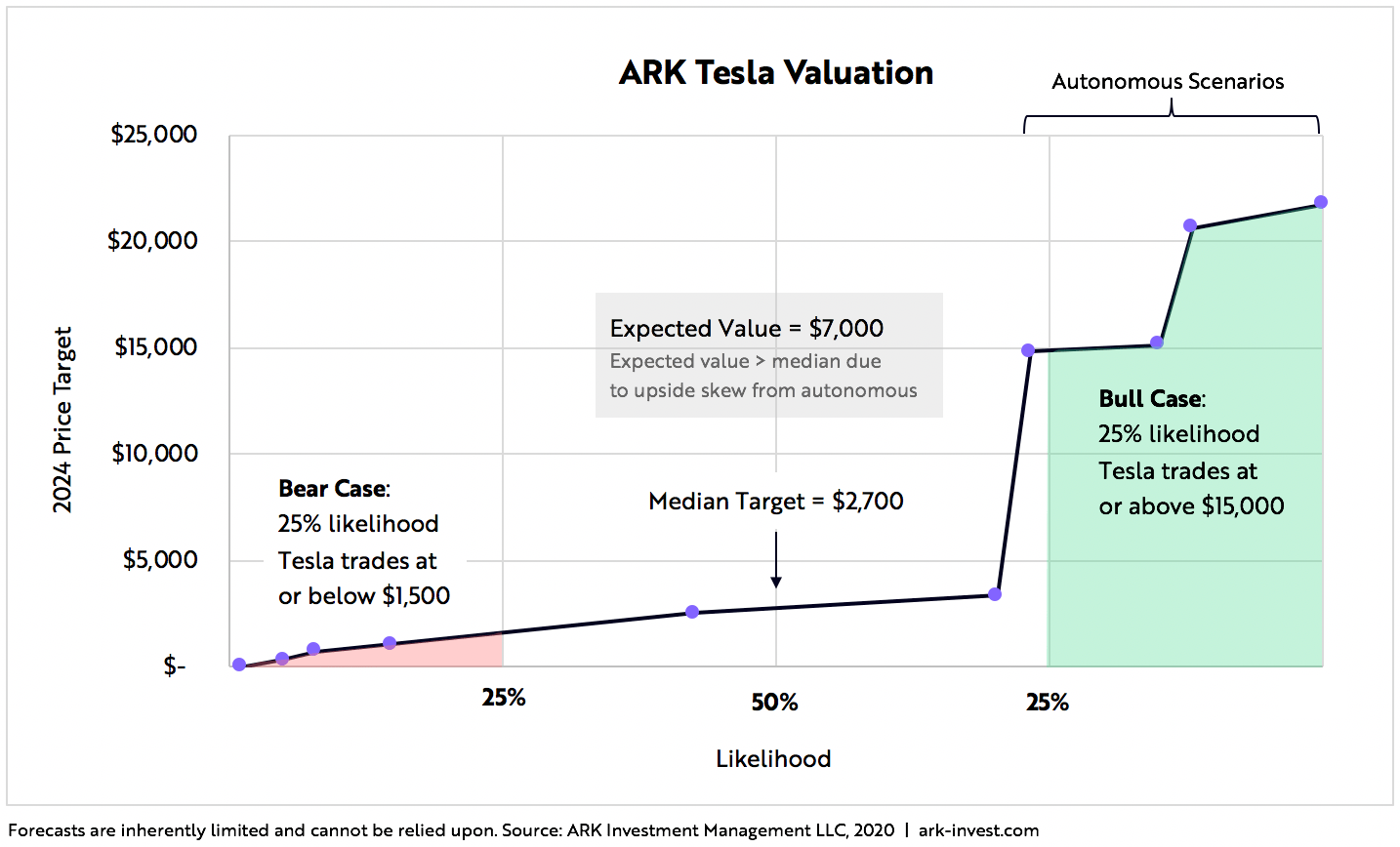

Woods prediction would mean Teslas market value easily exceeds 1 trillion within five years nearly 10 times the companys current valuation. Tesla is overvalued at 9255 billion and has an extreme premium.

Why Tesla Stock Plummeted 19 Last Month The Motley Fool

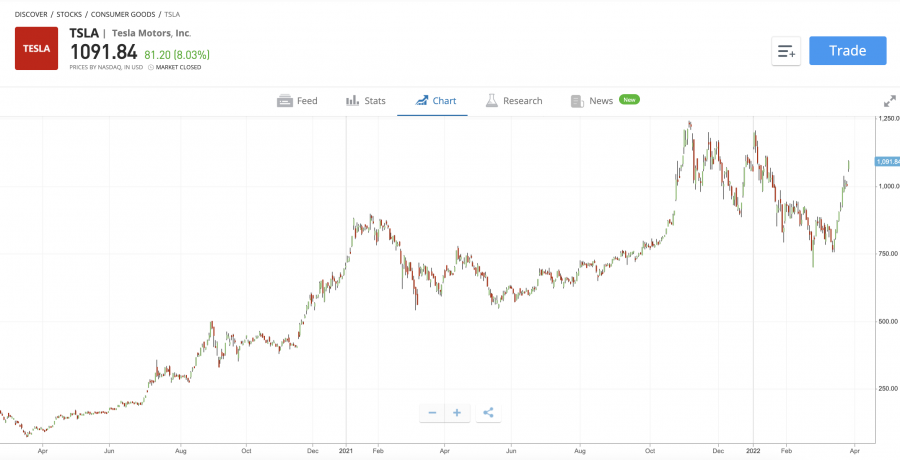

Teslas PE Ratio Almost Halved in a Year.

. Teslas market cap has doubled in the last 12 months to US59bn so its now more than BMWs. So Teslas one day jump was just under a quarter of that not more than all of it combined. Get Our Free Report to Find Out.

You are missing the point as to why Tesla is valued more than other car makers. Its earnings to valuation ratio is almost 10 times bigger than traditional carmakers. Why Tesla is traded on the stock market so high January 22 2020 by admin The global automotive industry is currently in a critical transformation phase which is particularly reflected in the relatively low market performance of the relevant actors as evidenced by a study by the Center of Automotive Management CAM.

Ad Are Electric Cars the Next Opportunity to Make a Fortune. Tesla CEO Elon Musk has built Tesla into one the most powerful brands in the world. For years potential competitors kept an eye on Tesla as it absorbed all the risk.

Its making losses of around US2bn on revenues of around US10bn. Lets compare that to. It pulled back 45 on Tuesday to 156836 a.

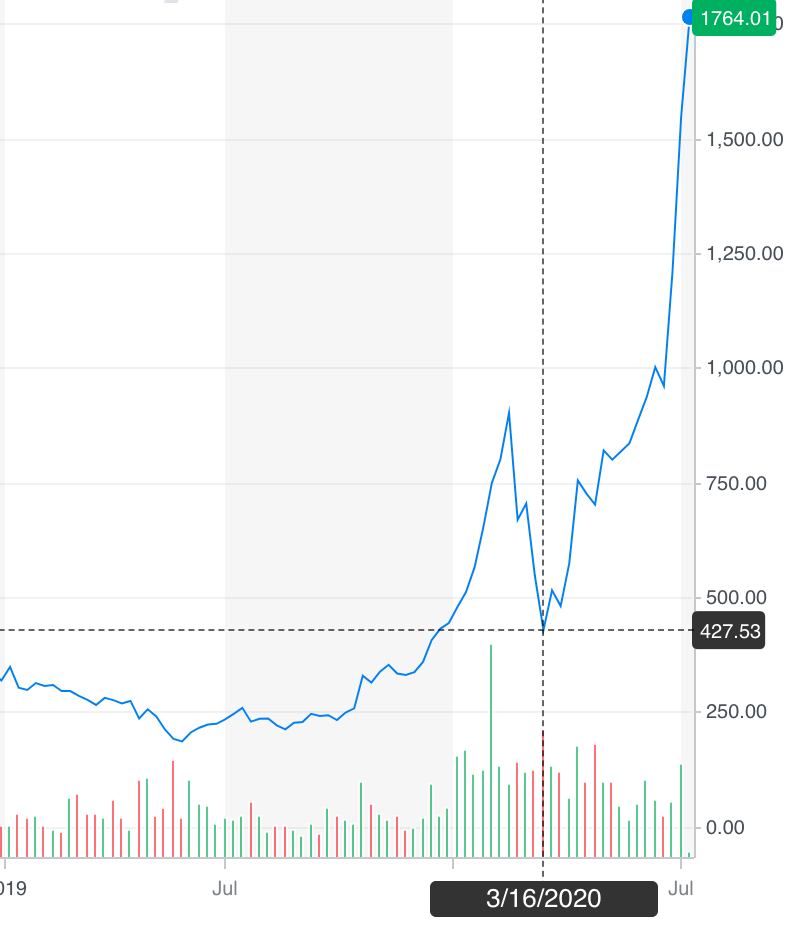

Less than a month after Teslas stock first rose above 400 the companys shares have now soared past 500 per share. TSLA continues to be the most shorted automaker stock and thats a positive for the company. As I write this one share of Tesla stock is worth 516 which means the.

Shares of Tesla TSLA -717 rose 243 in December according to data from YCharts. Teslas market cap is over 6000 times greater than its 2019 earnings. For comparison Fords PE.

Zacks Free Report Highlights Our Top Stock Picks. Shorts What makes Tesla different from other car companiesHow Is Tesla the biggest car companyWhy is Tesla stock so high compared to other car companies. The PE ratio is calculated as a stocks current share price divided by earnings per share in the last twelve months.

Similarly major Tesla shareholder Ron. At its current price of roughly 840 per share the stock trades at around 155x consensus 2021 earnings. The red-hot electric vehicle manufacturer appears to have benefited from being added to the S.

Thats more than 10 times the related numbers for its gasoline-powered rivals. Why Is Tesla Stock So High. TSLA is valued at 9255 billion.

Tesla stock has a sky-high valuation much to the delight of bulls and the disgust of bears. Teslas capital expenditure-to-sales ratio is also high at 149 which compares favorably to the sector median of just 26. Ad These 5 fascinating stocks are the most important investments for the next 90 days.

It has a price-to-earnings ratio PE of 1200 meaning that for every one dollar of earnings Tesla enjoys 1200 of market cap. The companynow with a market capitalization near 900 billionis worth roughly three. It sold only 34 as many vehicles as Toyota.

No publicly traded company trades on the sole basis of assets it is highly speculative of growth and near term earnings. So for a company that has reported losses of nearly 45 billion dollars over the last 4 years 2016-Present its stock is up 221. I dont believe Tesla the company is a Ponzi but the stock almost certainly will go down in.

Price sales or price revenue is another valuation metric. Three years ago when Tesla was worth 50 billion the companys board promised Musk a huge grant of stock if he could among other. The 10 others less the biggest three is 450 billion 1000 550.

Tesla trades for more than 1000 times historic earnings and 161 times estimated future earnings. On Monday Tesla stock climbed nearly 10 adding 265 billion to its market value in a single day. Its fundamentals dont come close to justifying its price.

The pandemic created the perfect scenario for a speculative stock like Tesla to flourish. A high PE ratio could mean a companys stock is overpriced or that investors are. They want Ford -- and other old-line manufacturers -- to adopt a new business model.

Are EV Stocks the Next Gold Rush. That means dramatic changes such as. It sells 25m vehicles a year.

Teslas market capitalization has increased by more than 500 billion in 2020 and the company is now worth about as much as that of the nine largest car companies globally despite selling a. -- Re-inventing their platform. Tesla trades for 23 times sales.

Using PE ratio Tesla is dramatically more expensive than other car makers like GM and Ford. Tiny company is a sneaky EV play that no ones talking about but should be. The reason investors are smitten with.

Overall while growth is expected to remain strong we still think Tesla stock is expensive. Teslas ability to drive environment consciousness by lowering CO2 emissions from manufacturing EVs and challenging 20th-century car manufacturers to do the same is of more value than any vehicle manufacturing stock on the market. It will struggle to sell 150k cars in 2017.

A higher PE ratio makes sense for Tesla because it has vastly more depreciable assets than NVIDIA but even going by the EV-to-EBITDA ratio which strips out depreciation NVIDIA sports a. Teslas stock continues to rise to ridiculous heights. The reason Tesla is trading so high is because of projected earning in the future and the belief that the company will continue to grow and innovate.

/1-e0618ab652664df6a8c0c2b9a8d90c1f.jpg)

Tesla Sell Off Intensifies Ahead Of Earnings

Tesla Stock Value Forecast Worth Trillions By 2030

Tesla Stock Value Forecast Worth Trillions By 2030

The Tesla Financial Complex How Carmaker Gained Influence Over The Markets Financial Times

How To Buy Tesla Stock In 2022 With 0 Commissions

Tesla Stock S 3 Big Issues After The Stock Split

Tesla Ceo Elon Musk Says Stock Price Is Too High Shares Fall

Why Tesla Stock Dropped This Morning The Motley Fool

Why Tesla Stock Tanked Today The Motley Fool

Why Tesla Stock Popped Before Earnings The Motley Fool

Elon Musk Tesla Share S Price Is Too High History Happens Next Tesla Shares Business News Today Tesla

Tesla Stock Value Forecast Worth Trillions By 2030

Tesla Stock Forecast Tesla Outlook Negative Despite Nearly 3 Surge Crowdwisdom360

Tesla Stock Closes Down More Than 12 After Musk S Twitter Deal

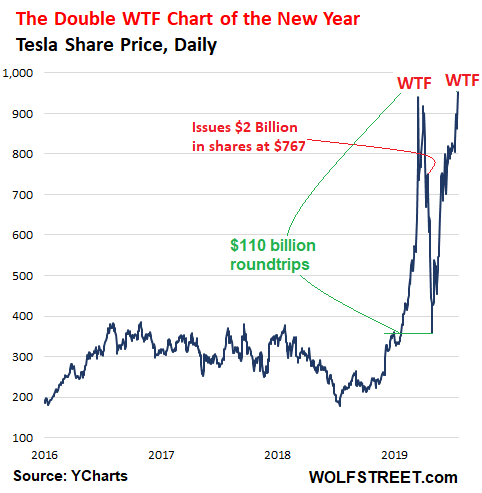

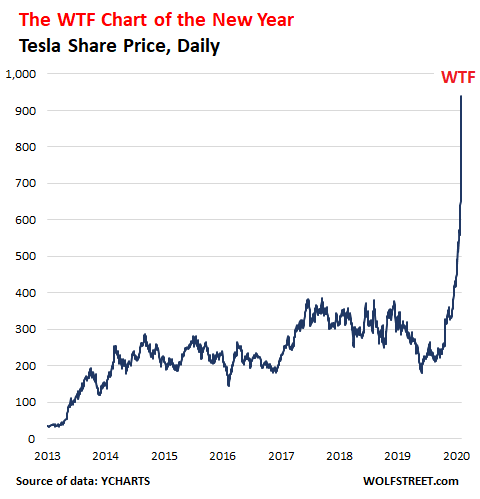

Tesla S Double Wtf Chart Of The Year Nasdaq Tsla Seeking Alpha

How To Buy Tesla Tsla Stocks And Shares Forbes Advisor Uk

Tesla S Double Wtf Chart Of The Year Nasdaq Tsla Seeking Alpha